Looking to expand your Shopify store worldwide? Need help setting up taxes on your products and collections? No worries, we’ve got you covered.

With the growing use of the Shopify e-commerce platform in different regions, merchants are now focusing on local taxation laws and compliance. They are also making changes to provide a localized experience for their diverse customer base.

To sell internationally, it’s crucial to set up taxes like Shopify VAT and consider enabling multicurrency support for a local buying experience. These areas often confuse sellers when customizing their stores.

In this article, we’ll dive into the details of charging VAT on Shopify and provide all the information you need, from basics to how-tos. Let’s get started!

- What is Shopify VAT and who does it apply to?

- When and when not to register for VAT?

- VAT for US, EU, non-EU and UK-based Shopify stores

- Charging Shopify VAT for B2B vs B2C customers

- How to set up VAT for your Shopify store?

- Adding VAT option in checkout using Wholesale Pricing Discount app

- Conclusion

What is Shopify VAT?

To start with the basics, Shopify VAT (Value-Added Tax) is a tax levied on the sale of products and services from your Shopify store, which the buyer indirectly pays. This means that Shopify sellers need to collect VAT from their customers at the time of sale (in checkout) and remit it to the respective tax authorities in their countries.

When setting up your Shopify store, it is essential to consider whether you need to charge VAT on your products and services if your buyers are from the EU member countries or the UK.

If your store is registered for VAT, built-in tax settings in Shopify allow you to configure it easily. But if you’re not sure about your VAT registration status or want to obtain a VAT number for your Shopify business, then take a look at this article by Stripe.

Now, let’s explore the proper way to charge VAT based on the location of your business.

When and when not to register for VAT?

Registering for VAT and charging it on your products is not a necessary step for every Shopify seller. Before you jump into enabling tax settings in Shopify, make sure to check if you fall under the criteria of mandatory VAT registration. Some common factors that determine whether or not you need to register are:

- Type of product: Not all types of products are taxed in all countries. Some are exempt from VAT.

- Location and threshold: Each country has its own minimum sales amount, after which you need to register for VAT. For example, the UK’s threshold limit is £85,000 in a rolling 12-month period.

- Cross-border trade: If you sell products to customers in other EU countries, their respective thresholds also apply. For instance, if you’re based in the UK and sell to France, the French threshold of €35,000 will also come into play.

VAT for US, EU, non-EU and UK-based Shopify stores

The VAT for EU, non-EU, and UK-based companies is charged differently.

Here are some use cases that’ll give you a better idea –

1. For Shopify businesses in the US

A US-based Shopify business selling products within the US

If you’re a US-based Shopify business, and all your buyers are from the United States, then you won’t need to collect VAT.

A US-based Shopify business selling products to customers from EU member countries

In the European Union (EU), each member country has its own VAT (Value Added Tax) rates and regulations. Therefore, the VAT rate you should collect depends on the specific country to which you are selling your products. For example, if you’re selling a product worth €100 to a customer in Germany, you’d also need to collect 19% VAT (€19) from them as per the German tax laws.

A US-based Shopify business selling products to customers from the UK

If you’re a US-based Shopify business selling products to UK citizens, then you’ll need to charge VAT at the UK’s standard rate, currently set at 20%.

2. For Shopify businesses in the EU member countries

An EU-based business selling products within the EU member countries

If your Shopify business is based in the EU (member states), you need to charge VAT as per the standard rate of your country (usually ranging from 17-25%).

An EU-based Shopify business selling products to customers from non-EU member countries

When an EU-based Shopify business sells products to customers in non-EU member countries, the VAT doesn’t come into play for those sales. Instead, sellers must collect the tax as per the import laws and regulations of the destination country.

An EU-based Shopify business selling products to customers from the UK

If your Shopify business is based in the EU and sells products to customers in the UK, then you’ll need to charge VAT at the UK’s standard rate of 20%.

3. For Shopify businesses in the UK

A UK-based Shopify business selling products within the UK

If you’re a business established in the UK and you’re making taxable supplies of products or services, you need to charge VAT on those sales at the standard rate of 20%.

A UK-based Shopify business selling products to customers from EU member countries

If your UK-based Shopify business sells products to customers in any EU member country, you’ll need to charge VAT at the standard rate of that particular country. For example, if you’re selling a product worth €100 to a customer in France, then you’ll also need to collect 20% VAT (€20) from them as per French tax laws.

A UK-based Shopify business selling products to customers from non-EU member countries

When a UK-based Shopify business sells products to customers from non-EU member countries, VAT does not apply to those sales. The sellers need to collect taxes as per the destination country’s import laws and regulations.

Note: The VAT registration threshold for the UK in 2023 was £85,000. So if you’re a small business with less than this threshold, you won’t need to register for VAT in the UK and collect it from your customers.

Charging Shopify VAT for B2B vs B2C customers

The buyer-seller scenario plays a significant role in VAT on Shopify. If you’re selling to both B2B and DTC on your store, then there might be differences in the VAT that you’ll charge on your products –

I. Selling to B2B customers

If you’re selling your products to your B2B/wholesale customers, you don’t need to collect VAT from them if they provide their valid VAT number during checkout.

Just make sure that your B2B customers have a valid VAT number so that they fall under the reverse charge mechanism in B2B transactions.

Don’t worry, we will show you how to set up tax exemptions for your EU-based customers later in this article.

II. Selling to B2C customers

If you’re selling your products to B2C customers, then you will have to collect VAT from them as per the tax rates applicable in their region. Later, you can remit it to the respective tax authorities.

How to set up VAT for your Shopify store?

We assume that so far, you know about how the VAT works for your type of business. Now, let’s look at how to set it up in your Shopify store based on your desired preferences.

A. Include VAT in product prices in Shopify

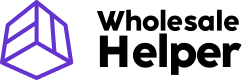

In countries like the UK etc., you might want to include VAT in your product prices. To do this, navigate to Settings > Taxes & Duties in your Shopify admin dashboard, and under Decide how tax is charged, select the checkbox “Include Tax in Prices“. And hit Save.

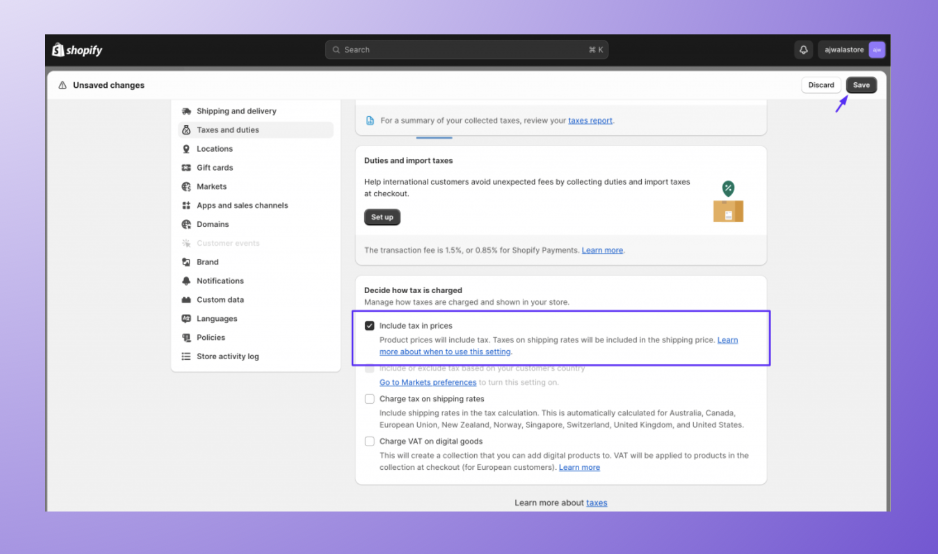

Once you have configured your prices to include taxes, do make sure the Charge tax on this product checkbox on your product page(s) (as illustrated below) is checked. By doing so, the value-added tax (VAT) will be added to and displayed alongside your current product prices. This ensures that your customers can easily identify the total order amount, including the added VAT, during the checkout process.

B. Include taxes based on your customer’s location

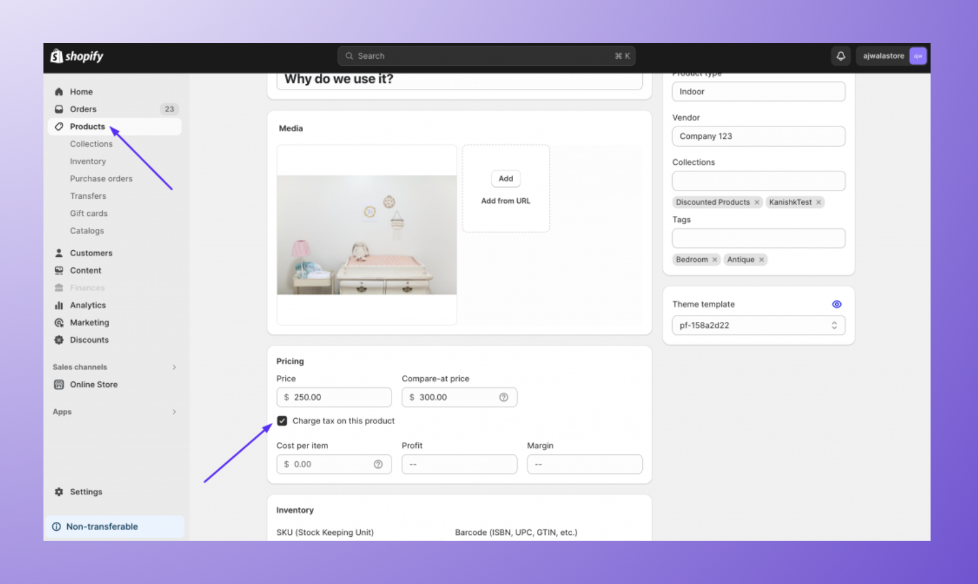

To set up a local tax rate for your customers (Shopify tax settings based on your buyer’s address), simply go to Settings > Markets > Preferences > Taxes and enable it as shown in the image below.

Also, if you want to do it manually for specific countries in the EU, then follow this

(Note: Do this if the European Union is not showing in your Taxes and Duties section)

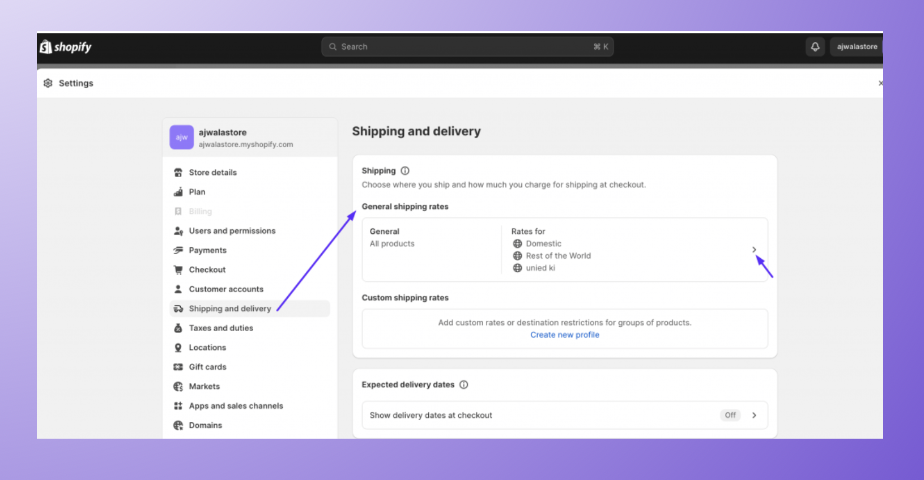

Go to Settings > Shipping and delivery > General shipping rates, click on the ‘>’ icon to add and collect taxes from selected countries.

Now, you can select multiple products that you want to ship to respective countries and add their local taxes or collect taxes from the customers directly from your store.

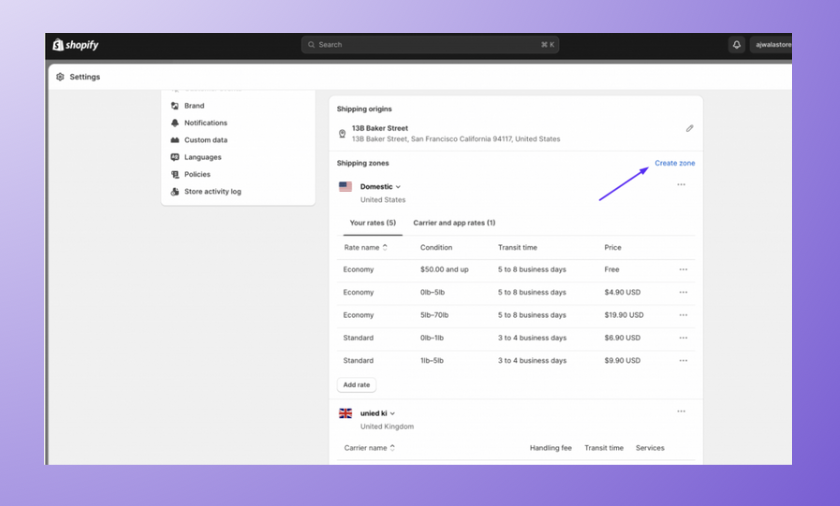

To do this, click on Create zone as shown image below –

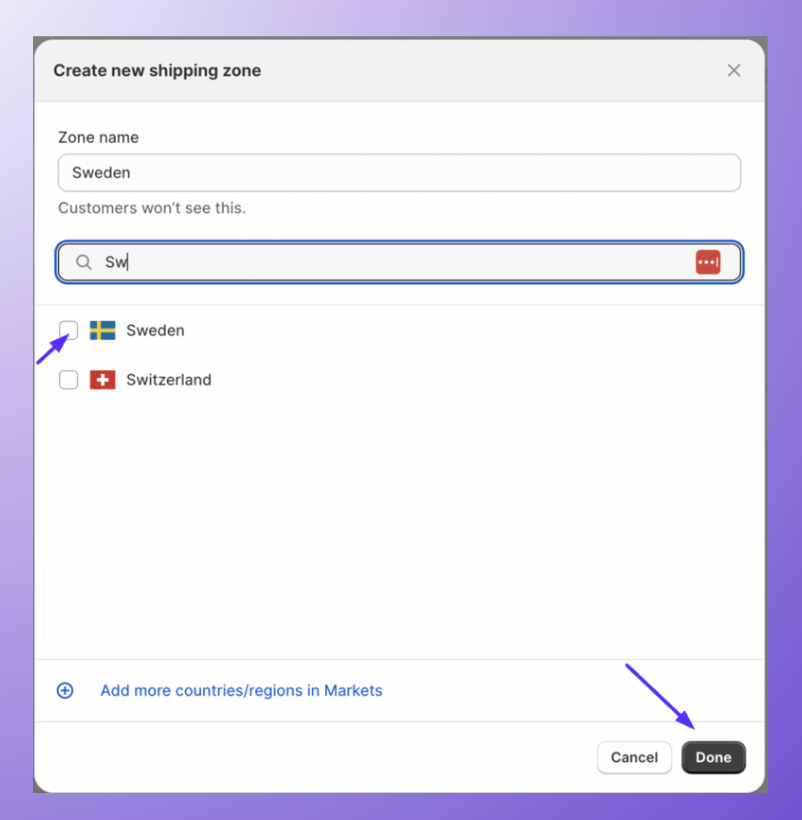

Now, add a market (for example: Sweden) as shown in the image below and hit Done.

Now, Save all the changes.

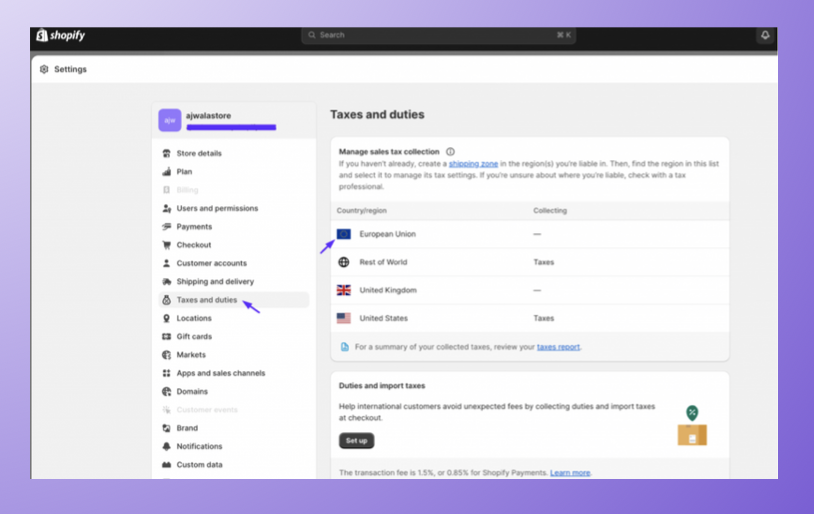

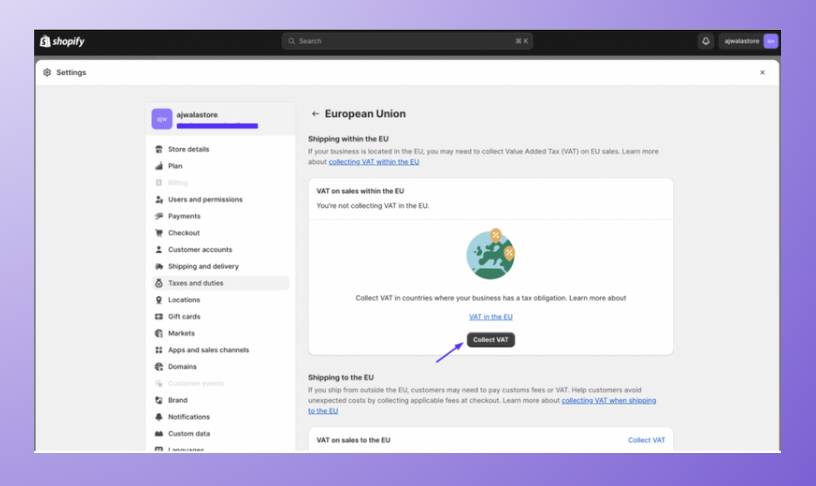

After that, head to your Tax settings and you’ll see the European Union option added to the taxes and duties section (shown in the image below).

Now, click on the Collect VAT button.

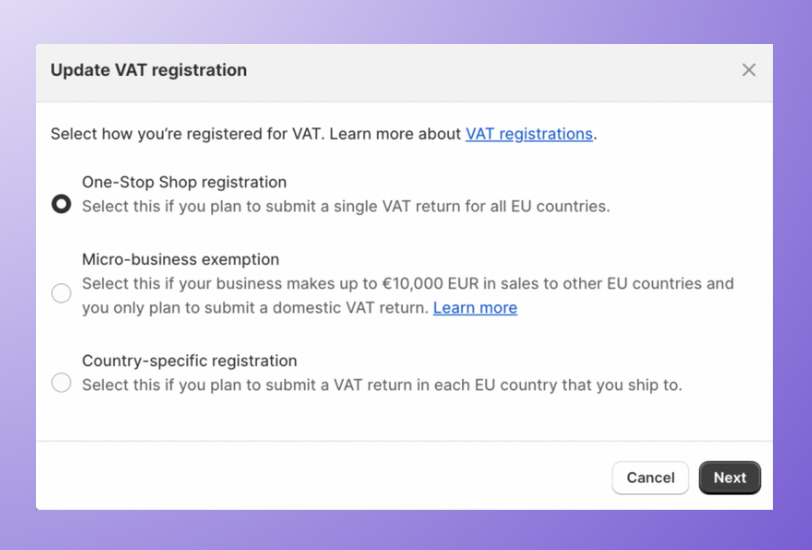

Here, you will see three options:

i. One-Stop Shop registration – Select this if you want to submit a single VAT return for all EU countries that you’re selling to.

ii. Micro-business exception – Select this if your business makes less than 10,000 Euros of sales in EU countries to be exempt from VAT and only want to submit a domestic VAT return.

iii. Country-specific registration – Select this if you want to submit a VAT return in each EU country that you ship to.

In our case, let’s choose Country-specific registration and click on Next.

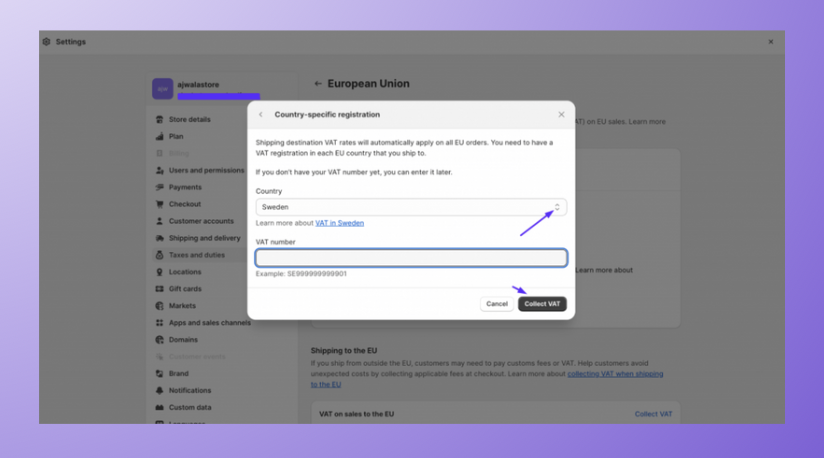

Now, let’s choose a Country (for example: Sweden), add your VAT number, and click on the Collect VAT button.

Note: If you need more information, you can check this help article from Shopify on collecting taxes in the EU.

c. Display/Add VAT information on checkout

By default, in your Shopify store, the cost shown to customers in the checkout order summary includes tax. If you prefer to display the precise tax amount being paid, follow these steps:

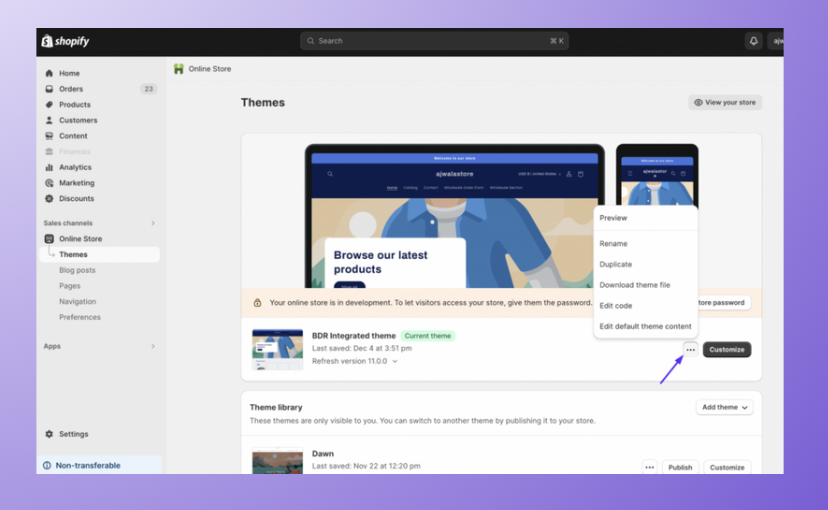

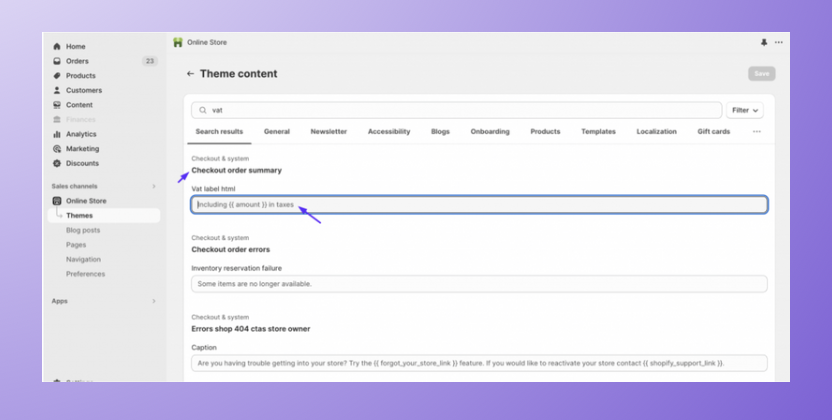

1. Go to Online Store > Themes > then click on … (three dots) button > Edit default theme content

2. Go to Theme content > Checkout order summary > Vat label HTML box enter Including {{amount}} in taxes

3. Click Save.

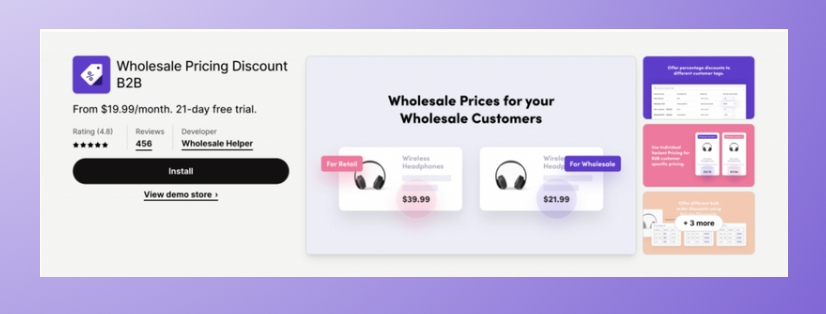

Adding VAT option in checkout using Wholesale Pricing Discount app

The Wholesale Pricing Discount app is a B2B app that seamlessly integrates with Shopify Markets. It allows you to show tax exemption for VAT and tax IDs (for B2B customers – based on customer tags, logged-in customers, and non-logged-in customers) during checkout.

- You can charge taxes from non-exempted customers who do not have a valid VAT number.

- Automatically collect VAT from non-exempted B2C customers without any interruption.

Note: You need the Wholesale Pricing Discount app installed in your Shopify store for this setup.

Conclusion

As we conclude our discussion on setting up Shopify VAT, it’s important to recognize its significance. For business owners aiming to expand their reach and serve customers from EU countries, implementing Shopify VAT is crucial. It demonstrates commitment to compliance, transparency, and fosters trust with customers.

By understanding VAT complexities, you can accurately collect and remit taxes while avoiding legal consequences. With the outlined steps in this blog post, setting up Shopify VAT can be a seamless process. So, take action now and confidently sell to EU countries! Remember, staying informed and up-to-date on tax laws is an ongoing responsibility. Stay updated with any future changes that may impact your business.

Thanks for reading 🙂

Ready to impress your B2B customers? Start wholesaling like a pro! 🙂

Try our Wholesale Pricing Discount app for free !

Frequently Asked Questions

How can I determine if I need to register for VAT for my Shopify store?

You need to register for VAT if your sales exceed the threshold in your country or if you sell to customers in other countries with their own VAT thresholds.

Can US-based Shopify stores be required to collect VAT?

Yes, if a US-based Shopify store sells products to customers in the EU or the UK, they may be required to collect VAT according to local tax laws.

What are the steps to set up Shopify VAT for a store?

To set up Shopify VAT, you can either use Shopify’s built-in tax settings or install a third-party app for more complex tax scenarios.

How does VAT work for B2B sales on Shopify?

For B2B sales on Shopify, VAT may not be charged if the business customer provides a valid VAT number, allowing for a reverse charge mechanism.

How do I include taxes based on my customer’s location in Shopify?

Enable local tax rates in Shopify’s tax settings to automatically adjust VAT based on your customer’s location during checkout.

![Shopify Loyalty Programs – A Complete guide [2025] Shopify Loyalty Program](https://wholesalehelper.io/blog/wp-content/uploads/2023/03/Shopify-Loyalty-Program.png)