Running a wholesale business on e-commerce? Offering net payment terms to your B2B customers can be a huge benefit. Not only will they help you get paid on time, but they can also help improve your relationship with your B2B customers.

In this article, we will discuss how to offer net payment terms and why they are such a valuable strategy for businesses. We will also provide some tips on things to keep in mind while offering net payment terms to your customers.

- What does Net Payment Terms mean?

- Why offer Net Payment Terms to your B2B customers?

- How to offer Net Terms to your B2B customers?

- Where to offer Net Payments Terms?

- How to keep track of your Net Payments?

- How to follow up on unpaid Net Payment Invoices?

- Tips for Offering Net Payment Terms

- Final Thoughts

- FAQs

What does Net Payment Terms mean?

Net payment terms simply mean that the customer pays you for your products or services within a certain number of days after they receive them.

For example:

(1) If you’re a business, you might offer net 30 payment terms, meaning the customer has 30 days to pay you after receiving their invoice.

(2) If you’re a customer, buying on net terms allows you to receive goods first and then pay at a later date.

Read Also: Automating Wholesale Invoicing and Payment Reminders On Shopify Store in 2025

Why offer Net Payment Terms to your B2B customers?

B2B customers typically buy in bulk and often have large orders. This can put a strain on their cash flow, which is why offering net payment terms to them can be so beneficial.

1. To help your B2B customers manage their finances

By offering net payment terms, you are essentially offering more time to your B2B customers to arrange money to make payment of their total order amount. This can help them immensely when it comes to managing their finances and can make them more likely to do business with you in the future.

2. To expand the number of customers who are able to buy

Net payment terms can also help expand the number of customers who are able to buy from you. This is because many businesses that sell b2b products have a strict policy when it comes to payment and requires all payments to be made upfront.

However, by offering net payment terms, your b2b business is giving more flexibility to potential customers who may not have the ability to pay for your products or services upfront.

3. To build better relationships with customers

Net payment terms can also be a valuable tool for building relationships with your customers. When you offer flexible payment options, it shows that you can be trusted whenever a customer is facing a cash flow problem and wants to buy products to sell further and make profits. This will show that you value their business. This way you create long-term, loyal customers who are more likely to do business with you in the future.

Looking to implement this on your Shopify store? Don’t miss our step-by-step guide:

👉 How to Offer Net Payment Terms on Shopify (2025 Setup Guide)

How to offer Net Terms to your B2B customers?

The first step in offering net terms to your customers is to make sure that you are clear about what the terms are.

The types of net terms payment you can offer to your B2B customers may include:

1. Net 15 payment terms

Net 15 means that you’re offering your customers 15 days to pay their invoice or the total order amount in full. This can be applied after the order has been delivered or fulfilled by you.

2. Net 30 payment terms

Net 30 means that you’re offering your customers at least 30 days to pay their invoice or the total order amount in full. They can also pay before 30 days.

3. Net 60 payment terms

This means the customer has 60 days to pay their invoice in full after the order delivery or fulfillment.

You will also need to decide when the (next) payment is due. For example, you might require that the customer pay their invoice within 15 days of receiving it, or you might give them 30 days.

Offer discounts for early payments

You can also choose to offer discounts to your B2B customers for paying or clearing their wholesale invoices before the due date or a specific time period. You can set this based on the total order value or on the number of days.

For example:

| Date of invoice | Net Term | Total order value | Pay Between | Early Payment Discount |

| 01-01-2023 | 15 Days | $1000 | 0-10 Days | 10% |

| 02-02-2023 | 30 Days | $2000 | 0-15 Days | 12% |

| 03-03-2023 | 60 Days | $3000 | 0-30 Days | 15% |

Net Terms discounts

Wholesale Pricing Discount’s Net Terms feature for the B2B Shopify stores:

Looking to implement this on your Shopify store? Don’t miss our step-by-step guide:

👉 How to Offer Net Payment Terms on Shopify (2025 Setup Guide)

Net Payment Terms examples

Example One: Company X offers net 30 payment terms to Company Y. This means that Company B has up to 30 days to pay their invoice from the date of purchase. If they do not pay within this time period, they will be charged a late fee.

Example Two: Company A offers net 60 payment terms to Company B. This means that Company D has up to 60 days to pay their invoice from the date of purchase. If they do not pay within this time period, they will be charged a late fee.

Once you decide on net payment terms, you need to convey or offer them to your customers.

Ready to impress your B2B customers? Start wholesaling like a pro! 🙂

Try our Wholesale Pricing Discount app for free !

Where to offer Net Payments Terms?

There are a few different places where you can offer net payment terms to your customers. Here are some common places you can mention or tell about the net payment terms for your products or services:

(i) In the order invoice

The most common place to mention your net payment terms is to add to the invoices. You can include them in the body of the invoice or in the footer.

(ii) On the website or checkout page

Another place you can offer net payment terms is on your website. If you have an e-commerce store, you can include the payment terms on the checkout page. This way, your customers will get an idea about what kind of products they can purchase and pay after a specific time period after the delivery.

(iii) In contracts

You can also include information about net payment terms in your contract with customers. This way, there you can prevent confusion about due payment dates and late fees if the payment is not done in a specific time or according to the decided net term.

(iv) Verbal agreements

You can also verbally agree on net terms with your B2B customers before you provide them with any goods or services. This is a good option if you want to ensure both parties understand and agree to the terms.

No matter where you choose to offer net payment terms, make sure that the terms are clear and easy to understand. You don’t want there to be any confusion about when payments are due or what the consequences are for late payments.

Also Read: The Ultimate Shopify Pre-Launch Checklist: Everything You Need To Know

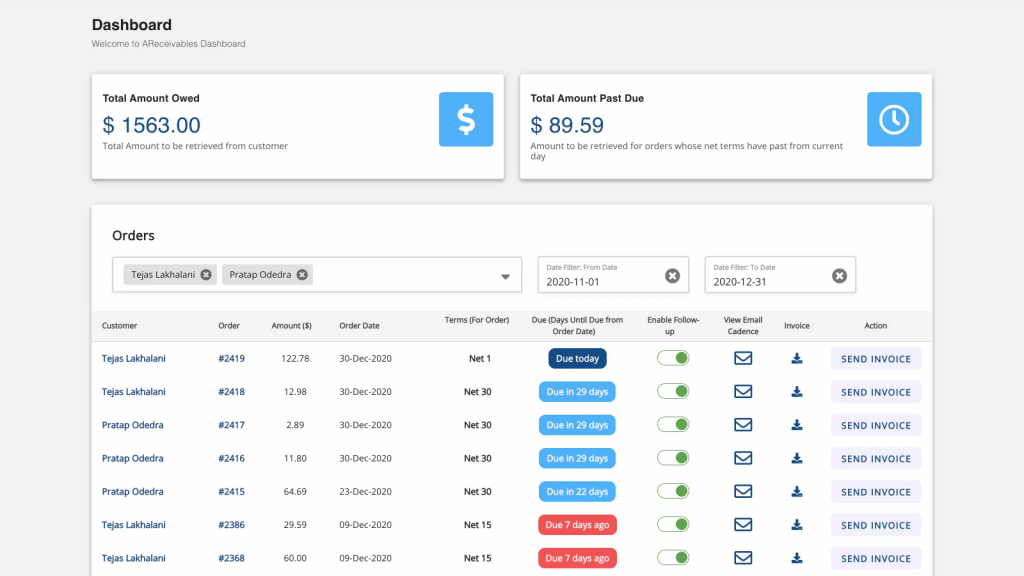

How to keep track of your Net Payments?

Once you have started offering net terms to your B2B customers, it is important to keep track of the payments. This will help you stay on top of your finances and make sure that you are getting paid on time.

There are a few different ways that you can keep track of net-term payments, such as:

- Manually keeping track of your payments in a spreadsheet or bookkeeping software. This can be a little bit time-consuming for your accounts team but it will give you overall control of your B2B payment records.

- Using invoicing software that offers this feature. This can save you a lot of time and hassle, as the software will automatically keep track of who has paid and when.

- You can also hire an external bookkeeper to keep track of your net terms payments for you. This is a great option if you want to free up your time to focus on other aspects of your business.

- If you’re running your e-commerce business on the Shopify store, you can use an account receivable app that will help you with tracking your net term payments and due amounts.

It is important to keep track of your net terms payments so that you can keep your business running smoothly.

How to follow up on unpaid Net Payment Invoices?

If you have B2B customers who have not paid their invoices within the agreed-upon net terms, it is important to follow up with them or send a reminder. This will help you ensure that you are getting paid on time and avoid any negative consequences for your business. Many modern businesses find it challenging to track payment due dates and ensure timely payments. Utilizing the best billing software can streamline this process, offering robust invoicing features and automating reminders, aligning with net payment terms.

There are a few different ways that you can follow up on unpaid invoices.

- Through a phone call to the customer

- Through an email reminder for payment or a physical letter by post

- Through an automated email drip campaign

If you still haven’t received payment after following up, you can hire a collections agency. This is the last resort, but it can help you get the money that you are owed.

Ready to impress your B2B customers? Start wholesaling like a pro! 🙂

Try our Wholesale Pricing Discount app for free !

Tips for Offering Net Payment Terms

Now that we’ve gone over what net terms are and why they can be so beneficial, let’s take a look at a few things you should keep in mind while offering net terms to your customers:

(a) Be Clear and Concise

Make sure that your invoices or contracts clearly state the net payment terms you are offering. This will maintain the transparency between you and your customer about payment due dates and other terms.

(b) Be Flexible

Don’t be afraid to negotiate payment terms with your customers. You may find that some customers are willing to pay more quickly if you offer a discount for doing so.

(c) Offer Incentives

Consider offering incentives for customers who pay their invoices on time. This could include a small discount or early access to new products or services.

(d) Get Paid Quickly

One of the biggest benefits of offering net payment terms is getting paid more quickly. To make sure this happens, set up a system for tracking payments and follow up with late-paying customers as soon as possible.

(e) Penalty for Late Payments

While offering net terms to your B2B customers, you can also choose to charge them a penalty fee for the late payment of a break in the agreement of the decided net terms. This will help you receive net payments on time from your customers.

By following these tips, you can make sure that offering net payment terms is a smooth and successful process for both you and your customers.

Final Thoughts

Net Payment Terms can be extremely beneficial to B2B businesses by helping to improve their cash flow situation. It’s important to be clear and concise when communicating Net Payment Terms to customers in order to avoid misunderstandings down the road.

Offering incentives for timely payments is another great way to encourage prompt payment from customers. Finally, setting up a system to track payments will help ensure that businesses are getting paid in a timely manner.

Ready to impress your B2B customers? Start wholesaling like a pro! 🙂

Try our Wholesale Pricing Discount app for free !

We hope that this article summarizes everything you need to know about offering net payment terms to your B2B customers. Let us know in the comments if we missed anything.

FAQs

1. What does net terms mean?

Net terms are the time a company allows customers to pay for goods or services before being charged late fees. It is an agreement between a customer and vendor/supplier that defines when payments are due (usually in days, such as “net 30” meaning you have up to 30 days from the invoice date to pay your bill).

Late or missed payments can incur penalties such as late fees, additional interest, collection costs or other consequences depending on the agreement terms.

2. What is the difference between net payment terms and other payment terms?

The main difference between net payment terms and other types of payment terms is that net payment terms usually involve an agreement between the customer and vendor/supplier, while other payment terms may not.

Other payment terms may include immediate payments or deferred payments, which do not involve an agreement between the customer and supplier.

Additionally, net payment terms typically involve late fees or other penalties if the invoice is paid after a specific amount of days. Other payment terms may not have any penalties associated with them for missing or late payments.

3. What factors should businesses consider when setting net payment terms?

When setting net payment terms, businesses should consider their overall cash flow and the cost of goods or services provided. Additionally, businesses should consider how long customers typically take to pay and what type of late fees may need to be imposed.

4. What are some common net payment terms used in different industries?

Common net payment terms used in different industries vary, but most typically involve 30 days or less. For example, some common net terms frequently seen include “net 10,” “net 15,” and “net 30.”

Additional terms might also be included in a customer’s agreement such as “2/10 net 20” which means if the customer pays within 10 days, they get a 2% discount.

Other industries may have different payment terms such as “net 60” or even “net 90.” Additionally, some industries might also require customers to pay in advance for goods or services.

5. What does term net 30 mean?

Net 30 is an agreement between a customer and vendor/supplier that states the customer has up to 30 days from the invoice date to pay their bill before any late fees are imposed. It’s one of the most common payment terms used in different industries, though other payment terms such as net 60 or 90 might be applicable depending on the industry

6. What does net term balance mean?

Net term balance refers to the amount of money owed by a customer to a vendor/supplier under an agreement for net terms. This balance typically includes all invoices that are unpaid, including any fees or penalties associated with late payments. The total amount due is typically calculated at least once a month and may be updated each time a payment is made.

![Shopify B2B: Build All-in-One B2B Store [2026 Guide] Shopify B2B article featured image](https://wholesalehelper.io/blog/wp-content/uploads/2023/04/Shopify-B2B.png)